Estimados interesados, me jubilé de la actividad de venta inmuebles.

Dear page visitors, I retired for the time being from my real estate activity.

Felices fiestas!

Season’s Greetings!

Asuncion Dec.2014

MercoAgro Real Estate

Farmland Uruguay Paraguay Argentina

agriculture investments, ranch property for sale

historic Estancias

. . .

Cerro Cora 1124

CP1544 Asuncion, Paraguay

mail@ventacampos

paraguay.com

Paraguay cel.+595-984-875014

farmland realtor since 1997

aditional resources :

Farmland Investments South America as asset class

farmland for sale Argentina Estancias

(paralel portal site)

guest ranches, estancias in uruguay

As real estate agents we offer farmland and rural properties in Uruguay and Paraguay, to a lesser extent in Argentina

We are investors in land ourself. We aim to offer properties and investments conservatively and thoroughly.

We can, when needed, offer integrated solutions with legal and administrative services providers involved and we cooperate with a number of local partner realtors and should be able to locate the property most suitable for you

- Paraguay arguably offers the best land price/value these days. The highest yielding farms (soya, sugar cane), intensivly operated and close to posessing plants

currently cost US$4000-9.000 per hectare, cattle ranch land US$500-2500, virgin land, forest covered in the semi arid Chaco region with good soil fertility costs US$200-600 per hectare. More on that on our offers land paraguay site.

Paraguay has the region’s most favorable tax regime, 10% personal income tax, 10% VAT.

On the down side Paraguay ranks not too high in rule of law or level of state institutions.

- Uruguay is in many aspects the opposite case. A mature civic society with strong rule of law and a distinctive european air.

Prices are those of a maturer market. With US$7.000-11.000 per hectare for prime crop land (soya, corn, wheat), US$2500-5000 per hectare for good cattle pasture. (which would include some fraction suitable for cropping), operational returns are typically in the 2-3% range. The value purchased is higher though then current returns indicate, farmland in Uruguay can potentially yield more and increased land values should lead to further intensification and hence higher yields.

Virgin land does not exist anymore in Uruguay.

Income is taxed in the 15-30% range, VAT being 22%

more at uruguay country information - taxes costs regulations immigration

Argentina and Bolivia are briefly discussed here :

raw land farmland investment news

Buyers of land have a basic decision to make

- buy farmland and operate it oneself, be it with more of a leisure aproach or be it with a professional approach if one has what it takes, or

- buy farmland and hire a management company to run it, with management fees reducing return to some extent, or

- buy farmland and rent it out, rental return typically being in the 3% range, requires less attention then any of the above, and income being rather (though not 100%) predictable, or

- buy raw land that has potential to be converted into farmland (land banking), least attention required, no operational return.

Virgin fertile land is our world’s ultimate limited asset. The purest form of land investment is raw (virgin) land real estate, where no premium is paid for anything man-made (like buildings or an operational farm set up).

Properties with potential for appreciation would have a favorable combination of climate, topograhy, soil fertility, environmental viability for agriculture.

We list some below offers land Paraguay Chaco.

Historic Estancias - investment in agriculture and gentleman farmer lifestyle combined : In Argentina as well as Uruguay a few historic estates, estancias, dating from the 1850s to the 1900s, survive to this day, often quite stately in their appearance, with 100 years old parks, inner courtyards, galleries, heavy wrought iron window bars etc.

It is a rare combination of reasonable agricultural potential and rural gentry lifestyle.

Until recently owners did not ask a premium when an estancia contained stately historic buildings, because they are costly to maintain. This has changed. Today a property with a fairly well maintained casco historico (“casco” meaning farmstead, or if stately, the mansion) and sufficient farmland to make it a viable operation, 300 hectare, grain-cattle combination, should cost US$2m (in both Argentina or Uruguay).

We list some below offers historic estancias.

.

|

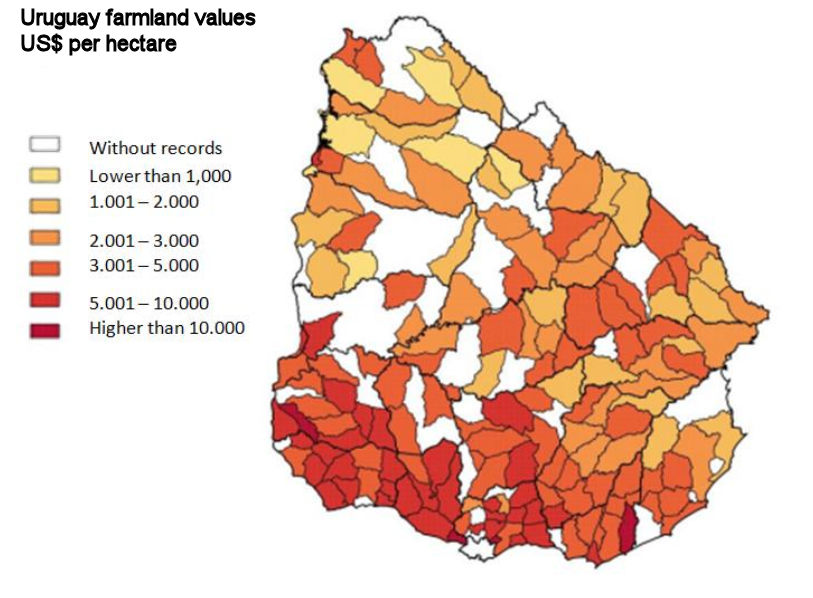

Uruguay land prices US$ per hectar (ha), 1 ha = 2,47 acre modest buildings and infrastructure in reasonable condition water is no issue in Uruguay, you have sufficient water supply everywhere, permanent streams or subsurface | |

| $ 1.200-1.800 |

marginal pasture land, (sheep, extensive cattle) agriculture partly limited by topography (steep slopes, wetlands) limited use for forestry due to lack of acces Coneat 20-70 |

| $ 1.800-2.500 |

marginal pasture land, (sheep, extensive cattle) but apt for forestry (appropriate soils, proximity to paved roads, paper mills) Coneat 40-90 |

| $ 2.000-3.000 |

pasture land apt for sheep, extensive to semi-intensive cattle breeding (feeding) some fraction of surface should allow pasture improvements Coneat 70-100 |

| $ 3.000-5.000 |

farmland apt for crop/cattle. Average or above average soil fertility (by high Uruguayan standards), allows for intensive cattle feeding operation, at least half of surface should allow pasture improvements. At least 20% of surface should allow feed crop or cash crop. Coneat 90-130 |

| $ 6.000-11.000 |

farmland on rich agricultural (sedimentary) soils apt for crops (corn, soya, wheat, sunflower etc), or crop/cattle rotation Coneat 120-200 |

|

additional 10% - 15% |

premium, if located in Uruguays southern, most developed belt, max 2h drive from either Colonia or Montevideo or Punta del Este |

land prices US$ per hectare per administrative unit, obviously not taking into account how particular properties differ from each other | |

"1 -2% operational return has usually been associated with agriculture in the UK", writes Financial Times’ in today’s Feb.19th 2015 article “UK farmland returns more than Mayfair”. The headline referred to the steep appreciation of some UK farmland, by 277%, in the decade to 2014.

Germany’s Handelsblatt wrote a few weeks earlier that rising national farmland values lead to rental returns being at 1,1%, down from 1,3% 10 years ago.

Values may be especially high in densely populated Western Europe and rental returns low, more so then, say, in the US, but still, low returns have been the universal rule in agriculture.

The more stable and eternal the intrinsic value of an asset, the lower the return buyers will still accept.

In its extreme, gold buyers will accept zero operational/rental return.

Farmland may be seen as being half way between gold and commercial real estate.

It shares with gold the fact that nobody can inflate the supply (though gold in the world does increase by some 1% annually thru mining, whereas global farmland rather decreases some 0,1% thru conversion or degrading), it shares with commercial real estate the fact that it is actually of use for something (producing food), you can rent it out and receive money in return.

And indeed farmland’s operational/rental return is roughly half way between those of gold and commercial real estate.

Then there is the residential/recreational value a farmland property may or may not have, which is diametrically opposite to operational return on investment/ROI. What the dollar buys more of the former, it naturally buys less of the latter.

The Tuscany wine estate or the spectacular scenery Rocky Mountains cattle ranch may cost as much as to just allow for an operational break-even, while the North Dakota potato farm may sell cheap enough to generate an ROI of 5%, or else nobody would go to live there.

Likewise a cattle ranch in benign climate Uruguay, that is a 90 min drive from glitzy Punta del Este may return 1% and the ranch in the Paraguay Chaco, one of the hottest climate, remotest, most sparsely populated areas on earth may return 7%

And then there is return thru appreciation, appreciation of farmland in Uruguay and the Paraguay Chaco was in the range of 500 – 700 % in the decade to 2014

as a consumer you should consider to turn to horse meat. It is delicious, tender and lean. But above all, the horse is no ruminant, it does not emit methane while digesting its food the way ruminants do.

Considering to become a cattle rancher in Argentina or Uruguay, do consider to become a meathorse rancher instead. Not that there would money to be made at current stage (2013), but methane emission is an issue mankind must address.

Further reading : horse meat

The news blog

on listings, news & opinion on farmland investment, subscribable onfarmland newsfeed

.

12/2014

weaker global agri commodity prices will take their toll on Uruguay's 2015 export earnings, combined soya/grains/rice earnings should be about USD1bn below previous year, partly offset by a substantial increase in wood pulp exports. Beef exports are expected to be stable ( uruguay country information )

12/2014

Uruguayan beef is about to be approved to enter the japanese market, the world's last major market to do so, writes Uruguayan newspaper El Observador.

(Abriendo la última puerta para la carne vacuna uruguaya)

12/2014

farmland values in Germany rose 80% from 2001 to 2013, rents rose some 50-60% with rental returns on asset in 2001 being some already modest 1,3%, diminishing to 1,1% in 2013, reports Germany's (Handelsblatt "Bauer sucht Land")

12/2014

Germany's Lateinamerika Verein's December 2014

country report on Uruguay

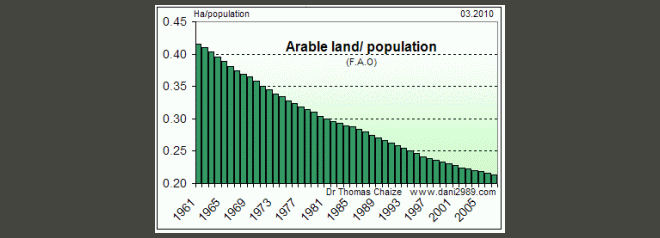

states that Uruguay with its 3 million inhabitants can feed 28 million people. That is a reassuring ratio in a world that has seen the ratio global arable land per capita halve to 0,2 hectare over the last decades.

12/2014

Uruguay’s governing “Broad Front”centre-left coalition winning yesterday’s elections by a strong margin has international press commenting quite positively on Uruguay. Financial Time’s Benedict Mander writes :

…leftist coalition that has presided over a decade of stability and economic growth (will govern) for another five years… widespread approval of the Broad Front’s mix of pro-business policies and welfare programmes… broad consensus between the different parties on economic policy…. Uruguay’s economy remains considerably more robust than neighbours Argentina and Brazil…

07/2014

construction started on Greek Lavania Holding's dry bulk (grain, wood pellets) terminal in the port of Montevideo, a US$100m investment to add further capacity to Uruguay's agro export infrastucture

03/2014

China became Uruguay's main trade partner in 2013 totaling 20.9% of all trade according to the Uruguayan Central Bank's latest statistics

03/2014

Uruguay major newspaper El País reports on 14.Mar.14 on nation-wide farmland sales values for 2013 being of some record breaking US$1,3bn (http://www.elpais.com.uy/economia/rurales/venta-tierras-tuvo-monto-record.html)

02/2014

Argentinean major newspaper La Nacion on 22.Feb.14 writes about Buenos Aires upper middle class middle age professionals preferring Uruguay as a new home. Number of cases quadrupled in 2013 from year before. Those interviewed state a generally higher life quality in Uruguay, better security and social peace , better education and public services, Montevideo being a healthy pleasant place, having waterfront, bicycle tracks etc (http://www.lanacion.com.ar/1666287-una-luz-al-otro-lado-del-rio)

01/2014

Marsh & Maplecroft, the economics intelligence providers, rate Uruguay as "Low Risk" as political country risk for foreign investors, for 2013 and again 2014. Of all countries of the Americas, it is a rating they only apply to the US, Canada, Chile and Uruguay.

![]()

HD map on : uruguay country information

12/2013

Transparency International, the global Berlin based NGO, ranks Uruguay 20th on its Corruption Perception Index among 177 countries rated (high ranking = low corruption), head on with the US and best rating amongst all Latin America, scoring better then France and Austria and Ireland

12/2013

The Economist, the renown British magazine, titled Uruguay "Country of the Year",

for legalising marihuana, but also, and of more relevance for the investor, for its political culture of soberness and transparency.

06/2013

GMO, the US fund management firm

acquired 45.000 hectare forestation land in northern Uruguay at roughly US$140M from Montes del Plata, the forestation and paper mill operator. Not being prime forestation land due to far distance to existing paper mills, it never the less posed a rare opportunity to purchase a parcel of such substantial size.

Being a transaction similar in nature, in December 2012 Ence, the spanish pulp producer sold 27.780 hectare at US$77M to another US fund.

Both transactions, due to buyers being investment funds, required specific permission by the uruguayan state.

06/2012

in 2010 our portal site stated that farmland prices in Uruguay were 30-40% of those of Northwestern Europe, it was now adjusted to 25-30%. Prices rose stronger in Europe then in Uruguay recently. Eastern German medium productivity crop land (comparing to aprox. Coneat 100) is currently offered at US$20.000/ha. Prices are similiar in the UK, but higher still in Netherlands, Denmark, western Germany.

06/2012

a 2010 world bank report shows map with estimated climate change effects on global agri yields, confirming the common view that high lattitude regions will win, and most others loose, Uruguay neatly standing out though

![]()

HD map on : uruguay country information

previous

Uruguayan gras-fed beef

in New York City restaurants makes it into the lifestyle section of the Financial Times.

previous

In a Barron’s article about farmland

Mark Faber mentiones farmland opportunities in Paraguay and Uruguay.